Sometimes the Easy Choice is a Good Choice

Feb. 4th, 2022 10:55 amRead almost any article about 401(k) retirement plans in the US and you'll see negatives in the story if not in the headline. Americans aren't taking advantage of their 401(k) plans, they're not saving enough in them, they're missing out on company matching funds, they're given weak investing choices or choose under-performing funds, etc. Using 401(k)s has never been an issue in our household; we've invested in them since we were first eligible. And for at least the past 15 years we've been saving robustly. But we're not all equally interested in spending time to figure out which funds to invest them money in. I enjoy that research; Hawk does not.

This issue came up again several weeks ago when we compiled an end-of-year checkpoint on all our assets. Hawk noted, "Uh-oh, I never figured out which fund to put my money in at my current employer." As she started there 3½ years ago I was worried, too, about money languishing in an under-performing fund.

Dealing with issue waited another few weeks. Again, while I'm always interested in doing financial research, Hawk hates it. And since it's her retirement money, her retirement account, I can't just do it for her. I can look over her shoulder and help out, but she's still got to allocate a modicum of time and energy for the task.

Long story short, it turns out there was no reason to worry. Her money (from this employer, at least) is invested in a good fund. And it didn't even take a lot of effort. It was like pressing the proverbial Easy Button.

Long story short, it turns out there was no reason to worry. Her money (from this employer, at least) is invested in a good fund. And it didn't even take a lot of effort. It was like pressing the proverbial Easy Button.

Longer version of the story:

As I saw where her money was invested, in a T. Rowe Price Target Date fund, I recalled that our conversation 3½ years ago went something like:

H: Ugh, I hate having to pick how to invest my 401(k) money.

Me: How many choices are there?

H: More than 20. I don't have time for this.

Me: Let's see if there's a quick reasonable answer to choose for now, then you can revisit it in a few weeks.

H: What about these target date funds? 2020, 2025, 2030, 2035; there's, like, 10 of them.

Me: Sure. Pick one for 10-15 years after you think you'll retire.

Target Date funds aren't always the best choice. They're mixtures of basic stock index funds and bonds, with the ratio between the two weighting more heavily to bonds the nearer the target date. The ratios are too bond heavy for people in our situation. That's why I recommended she pick a target date 10-15 years later than what general advice recommends. But even with that, there's the problem that the underlying stock funds can be are average at best.

In this case, though, the "easy button" choice of a Target Date fund turned out to be a good one. As I studied the performance statistics of the other fund choices over the past 1, 3, and 5 year intervals, I found that none of them beat her years-away Target Date fund.

Part of that I credit to the nature of the stock market the past few years. First, big growth stocks were frothy, so funds that invested in the few biggest names did well while others languished. Then, in the last month, the big growth names have taken a hit, so those once high-flying funds have come back down to earth. There's a bit of the "Slow and steady wins the race" lesson here.

The other part of the Target Date fund's victory I attribute to it being a T. Rowe Price fund. They have a very strong fund offering, with strong teams of researchers balancing return vs. risk of the stocks they pick. Not all Target Date funds are as good as theirs. I know in the past I've looked at Target Date funds in my plans and thought, "Meh."

This issue came up again several weeks ago when we compiled an end-of-year checkpoint on all our assets. Hawk noted, "Uh-oh, I never figured out which fund to put my money in at my current employer." As she started there 3½ years ago I was worried, too, about money languishing in an under-performing fund.

Dealing with issue waited another few weeks. Again, while I'm always interested in doing financial research, Hawk hates it. And since it's her retirement money, her retirement account, I can't just do it for her. I can look over her shoulder and help out, but she's still got to allocate a modicum of time and energy for the task.

Long story short, it turns out there was no reason to worry. Her money (from this employer, at least) is invested in a good fund. And it didn't even take a lot of effort. It was like pressing the proverbial Easy Button.

Long story short, it turns out there was no reason to worry. Her money (from this employer, at least) is invested in a good fund. And it didn't even take a lot of effort. It was like pressing the proverbial Easy Button.Longer version of the story:

As I saw where her money was invested, in a T. Rowe Price Target Date fund, I recalled that our conversation 3½ years ago went something like:

H: Ugh, I hate having to pick how to invest my 401(k) money.

Me: How many choices are there?

H: More than 20. I don't have time for this.

Me: Let's see if there's a quick reasonable answer to choose for now, then you can revisit it in a few weeks.

H: What about these target date funds? 2020, 2025, 2030, 2035; there's, like, 10 of them.

Me: Sure. Pick one for 10-15 years after you think you'll retire.

Target Date funds aren't always the best choice. They're mixtures of basic stock index funds and bonds, with the ratio between the two weighting more heavily to bonds the nearer the target date. The ratios are too bond heavy for people in our situation. That's why I recommended she pick a target date 10-15 years later than what general advice recommends. But even with that, there's the problem that the underlying stock funds can be are average at best.

So Many Choices

Once Hawk logged in to her account I started looking through the investment choices to find something better than her Target Date fund. There were a lot of choices there; at least 20. I know that level of choice intimidates a lot of people. One of my own colleagues described throwing his hands up in exasperation at the 20+ choices in our company plan. He decided not to fund his 401(k) at all! The problem of too much choice being a bad thing is real.In this case, though, the "easy button" choice of a Target Date fund turned out to be a good one. As I studied the performance statistics of the other fund choices over the past 1, 3, and 5 year intervals, I found that none of them beat her years-away Target Date fund.

Part of that I credit to the nature of the stock market the past few years. First, big growth stocks were frothy, so funds that invested in the few biggest names did well while others languished. Then, in the last month, the big growth names have taken a hit, so those once high-flying funds have come back down to earth. There's a bit of the "Slow and steady wins the race" lesson here.

The other part of the Target Date fund's victory I attribute to it being a T. Rowe Price fund. They have a very strong fund offering, with strong teams of researchers balancing return vs. risk of the stocks they pick. Not all Target Date funds are as good as theirs. I know in the past I've looked at Target Date funds in my plans and thought, "Meh."

The deal is a 100% match on the first $4,000 contributed annually. Oddly the matching starts with the first payroll in November. I mean, hey, the sooner the better.... But starting it late in the year is a rough fit for me because I've been funding my 401(k) to hit the maximum contribution for the year. I don't have $4,000 of eligible contributions left with which to max out my company's match.

The deal is a 100% match on the first $4,000 contributed annually. Oddly the matching starts with the first payroll in November. I mean, hey, the sooner the better.... But starting it late in the year is a rough fit for me because I've been funding my 401(k) to hit the maximum contribution for the year. I don't have $4,000 of eligible contributions left with which to max out my company's match.

A short squeeze is nothing new on Wall Street. The news here is all about who is making the squeeze. It's not the big-money hedge funds in Manhattan and Chicago. It's an army of small-money retail investors. They're using Millennial-friendly free stock trading platforms like Robinhood and coordinating in social media forums like WSB. WSB, a cesspool of rampant sexism and homophobia (it bills itself as "4chan with a Bloomberg terminal"), has seen its membership swell to over 5 million users in just a week.

A short squeeze is nothing new on Wall Street. The news here is all about who is making the squeeze. It's not the big-money hedge funds in Manhattan and Chicago. It's an army of small-money retail investors. They're using Millennial-friendly free stock trading platforms like Robinhood and coordinating in social media forums like WSB. WSB, a cesspool of rampant sexism and homophobia (it bills itself as "4chan with a Bloomberg terminal"), has seen its membership swell to over 5 million users in just a week.

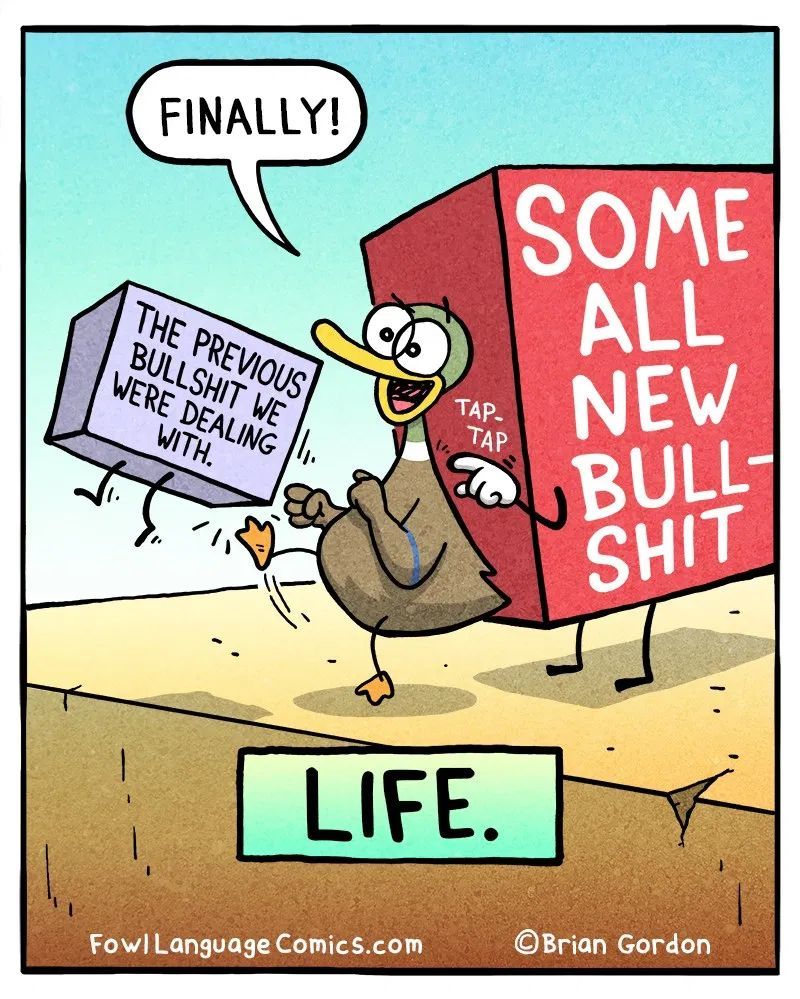

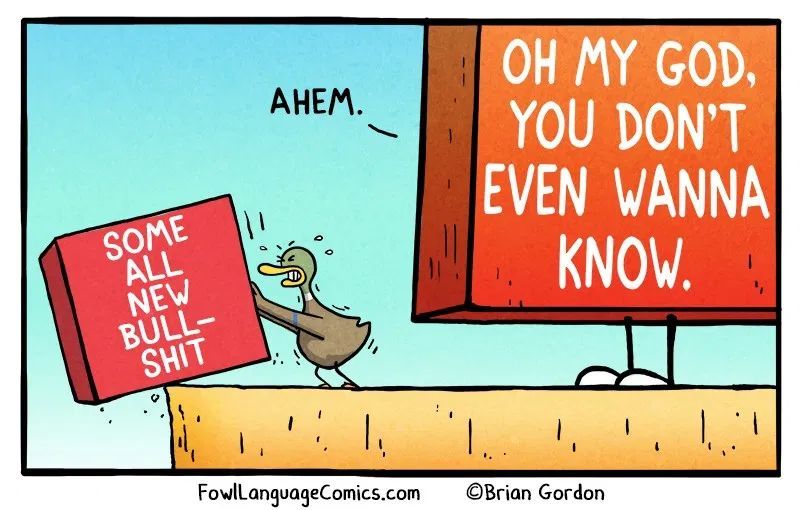

In the past I'd wondered if something could happen that's so overwhelming it's headline news in every category simultaneously— politics, money, health, life, entertainment, sports, etc. In 2020 exactly that happened.

In the past I'd wondered if something could happen that's so overwhelming it's headline news in every category simultaneously— politics, money, health, life, entertainment, sports, etc. In 2020 exactly that happened.

As we close the book on 2020— or slam it shut— it's tempting to think how much better 2021 will be. And probably it will be better. Coronavirus vaccines were developed in record time (not actually surprising in light of the science behind the development but still historically fast) and are now available. As they roll out across 2021 we may not vanquish Coronavirus but should at least beat it down that life can largely resume pre-2020 normality.

As we close the book on 2020— or slam it shut— it's tempting to think how much better 2021 will be. And probably it will be better. Coronavirus vaccines were developed in record time (not actually surprising in light of the science behind the development but still historically fast) and are now available. As they roll out across 2021 we may not vanquish Coronavirus but should at least beat it down that life can largely resume pre-2020 normality.